What is Bitcoin Mining and How Does Mining Work?

Bitcoin (BTC) and other cryptoasset miners have been forced to employ various strategies to hedge risks, said researchers at the Cambridge Centre for Alternative Finance, but most of these attempts are still "elementary." A cryptoasset mining farm. Source: Adobe/hlxandr

Bitcoin miners

Contracts are key to implementing a " Collar ," one of the most common hedging strategies for crypto inventory. To use a Collar, miners buy two kinds of options simultaneously. They would buy.

How to Hedge Bitcoin Risk Cryptocurrency Hedging Explained IG EN

On the contrary, if you rely on your mining earnings to cover the costs of your operation, you can explore the different hedging strategies listed above. Just remember to always keep your plan.

:max_bytes(150000):strip_icc()/dotdash_Final_How_Does_Bitcoin_Mining_Work_Dec_2020-02-5e922571968a41a29c1b01f5a15c2496.jpg)

How Does Bitcoin Mining Work? What Is Crypto Mining?

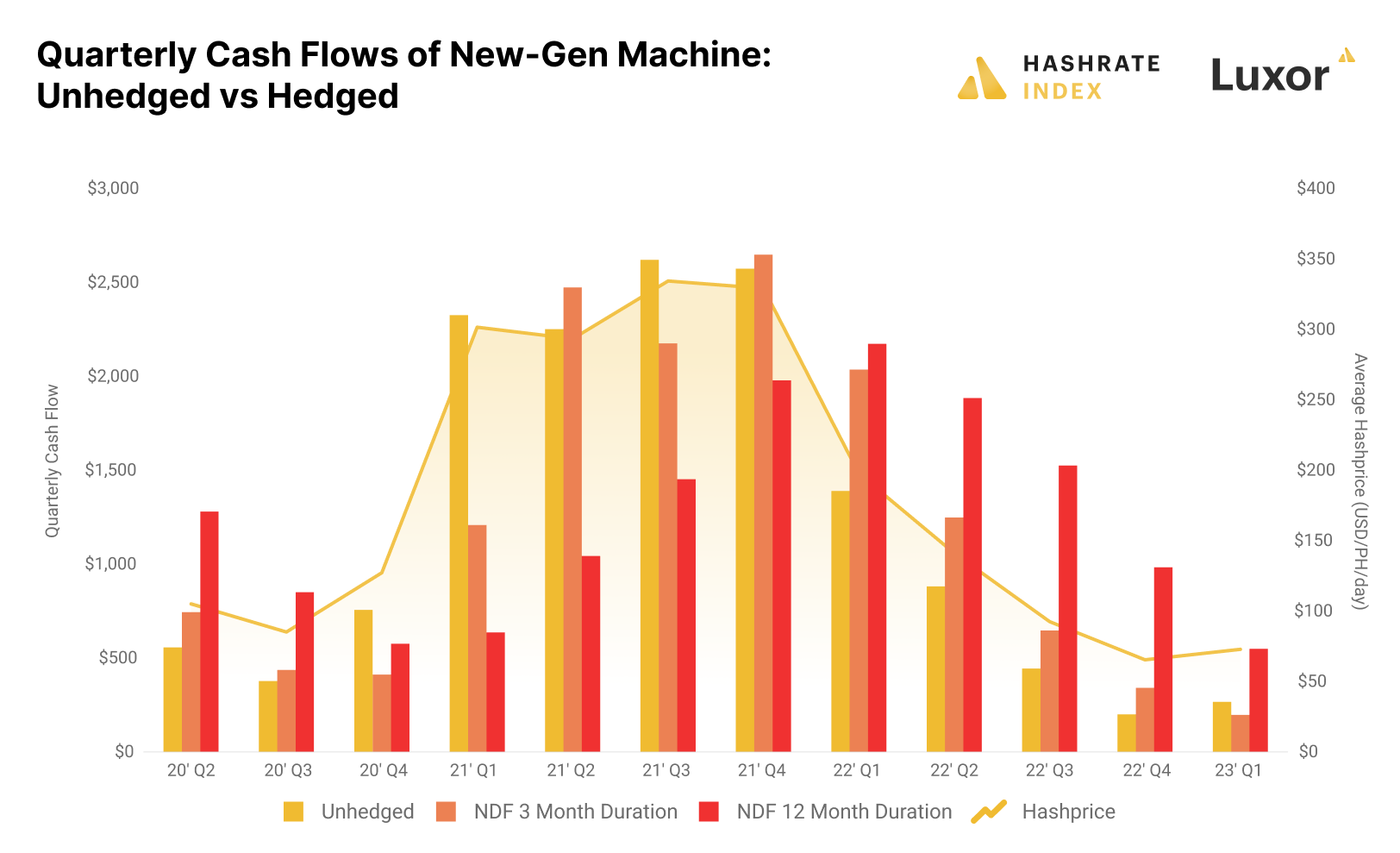

However, given that Bitcoin's mining difficulty adjusts to match a 10 minute block time, the average hashrate will generally be proportional to average difficulty and thus, difficulty futures.

Bitcoin Miner Selection Leveraging Social Proof to Navigate Payment Methods and Product Choices

Many miners also opt to join a mining pool, which allows small miners to earn income directly from the contribution of hash power, rather than relying on the "luck" required to successfully mine a bitcoin. The mining pool operator will collect 1-2% in fees from the miners, and in return, the miners get an income stream of small frequent payouts.

Bitcoin Miners Records 52.3 Million In Fees In A Day Learn How To Trade Cryptocurrency

Introduction: Hedging in Bitcoin Mining for Sustainable Profitability. Over the years, as businesses have become more sophisticated in their operations, so too have their budgeting, risk management, financial analysis, and hedging strategies. Locking in revenues and commodity input costs through hedging has enabled these companies to plan.

Who are the Bitcoin Miners?

cryptonews.com 06 September 2023 10:05, UTC Bitcoin (BTC) miners are considering hedging options to protect their revenue stability amidst the volatility of the cryptocurrency market. GSR, a leading firm in the trading and market-making space, is pitching hedging products that would provide miners with a more predictable income.

How hedging strategies can help Bitcoin miners lower their cost of capital

This year it has fallen well short of its own production targets set last year of mining 55 to 60 bitcoin a day and predictions of generating mining profits of between $86.5mn and $103.6mn a month.

Bitcoin Miners Get Another Way to Hedge with the New Instrument Analytics Insight

Crypto mining risk overview A crypto miner's revenue risk comes from changes in cryptocurrency prices and network hash rate. When the network's hash rate increases, miner's bitcoin denominated revenue decreases. Therefore, a miner's default position is 'short hash rate'.

Two Ways to Hedge Bitcoin/Cryptocurrency Mining Profit Volatility by Oliver hu Medium

Polkadot $9.33 7.27% TRON $0.106209 -1.36% Chainlink $15.63 1.87% Polygon $0.902389

.png)

Developing a Bitcoin Hedging Strategy Bitbuy.ca

Step 3: Take a counterposition. You can hedge the risk by taking a position in a related instrument that is expected to move in the opposite direction of the risk identified. The goal of hedging isn't to make money but to protect from losses. The gain on the hedging position should offset the losses from the main position.

This simple Bitcoin options strategy lets traders profit while also hedging their bets

An even bigger technological green gamble is being taken by Crusoe Energy Systems, which has raised $250 million, mostly to mine bitcoin in the middle of remote oil-and-gas fields in six states.

Bitcoin Hashrate the Definitive Guide and Optimal Hedging Strategies for Miners Bluesky Capital

Crypto miners are hunkering down for a possible squeeze as rising costs, swinging Bitcoin prices, and now a war in Ukraine threaten to erode the industry's substantial profit margins.

Bitcoin Miners Are Pivoting in Search of Profits—And Hedging Their Bets Decrypt

Bitcoin (BTC) miners are considering hedging options to protect their revenue stability amidst the volatility of the cryptocurrency market. GSR, a leading firm in the trading and market-making space, is pitching hedging products that would provide miners with a more predictable income.

Bitcoin miners might be hedging in anticipation of halving

Using Luxor's Hashprice NDF, the miner is able to achieve hedged profit of $9,000 total or $8.33 per MWh despite significant variability across scenarios. Now let's consider a more common short hedge strategy. Suppose the Bitcoin miner wants to hedge enough hashrate to cover operating expenses for 30 days.

How the U.S. became the world's new bitcoin mining hub

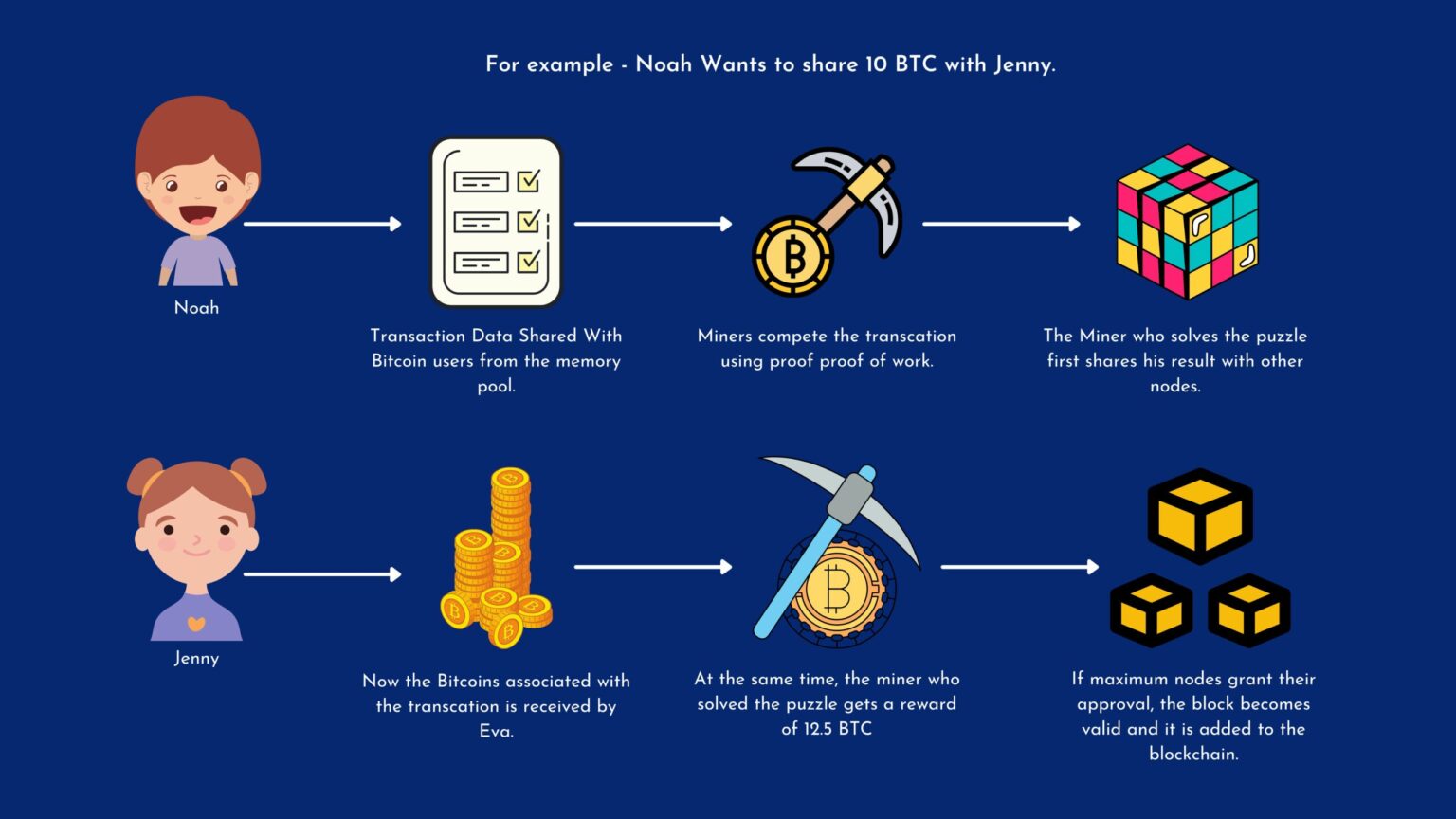

Mining Difficulty In order to determine if a hash guessed by a miner is correct, he must check if its value is lower than a positive number called nonce. The nonce represents the difficulty on the network on validating a block.