Vat Numarası Nedir? Nasıl Geri Alınır? Vat Numarası Örneği Tercihini Yap

VAT Numarası Nedir? VAT (Value Added Tax) Türkçe'de katma değer vergisi anlamına gelir. Tanım ve uygulama olarak Türkiye'deki KDV'nin karşılığıdır. Avrupa Birliği yasalarına göre her devletin bir VAT vergi prosedürü ve kimlik numarası bulunur.. Everything About German VAT Number Mart 31, 2023 Yalmans; Amazon Europe.

VAT in UAE Value Added Tax in Dubai VAT SAB Auditing

This utility provides access to VIES VAT number validation service provided by the European commission. It also supports VAT checking for countries which are not part of the EU VAT Scheme such as Great Britain and Switzerland. Example: GB731331179 for Great Britain, CHE-193.843.357 for Switzerland, NO974761076 for Norway.

Eihracat Nedir? Eihracat Nasıl Yapılır? Navlungo Yurt Dışı Kargo, Eihracat ve Lojistik Blogu

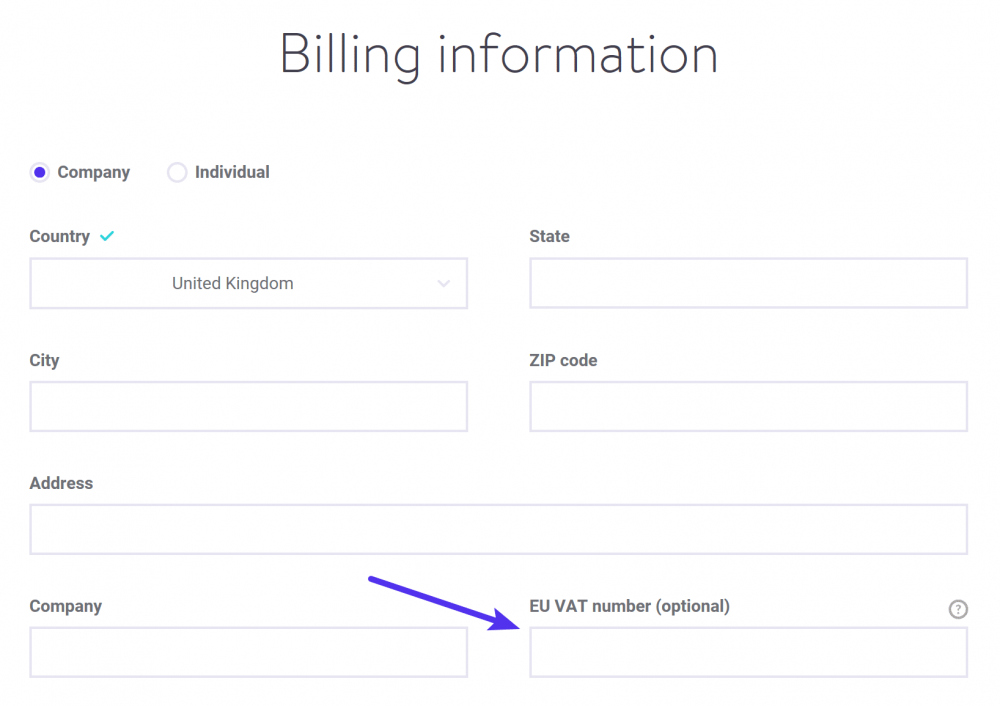

Help to identify the place of taxation Mentioned on invoices (except simplified invoices in certain EU countries) Sometimes also known as a VAT registration number, this is the unique number that identifies a taxable person (business) or non-taxable legal entity that is registered for VAT.

Vat Numarası Nedir? Nasıl Alınır ve Neden Alınması Gerekir? Yalmans

VAT-Search has more than 600 clients including . Contact API Docs Imprint GTC About VAT-Search.eu Language: VAT (Value Added Tax) ID - Numbers Search Lookup Checker. VAT-Search.eu. VAT-Search Pricing Log in. Paid Advertisement. VAT-Search in. Who? Where? VAT-Search has more than 600.

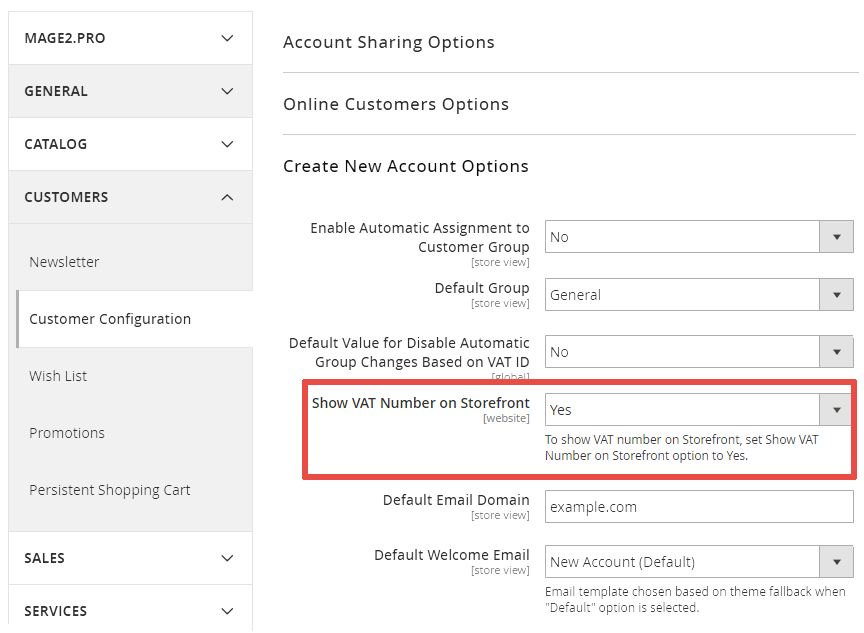

VAT Number Nedir? VAT Numarası Nasıl Öğrenilir? Navlungo Yurt Dışı Kargo, Eihracat ve

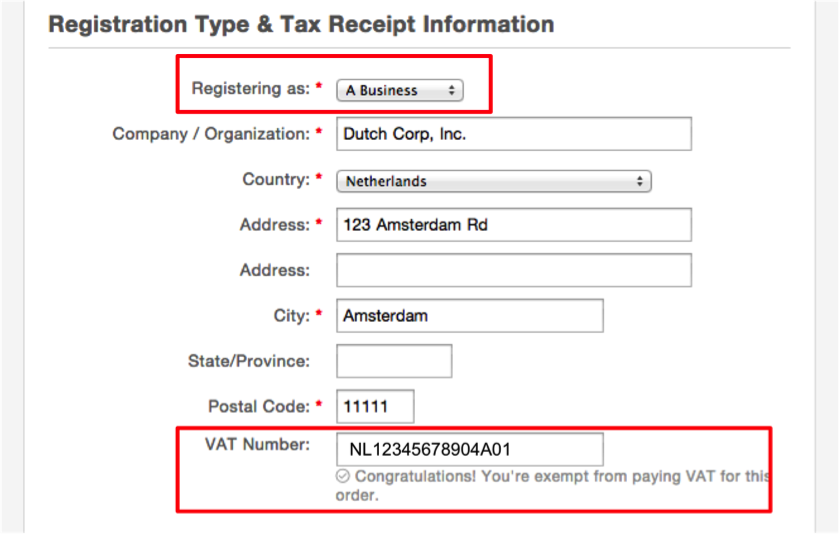

A VAT number is a registered tax identification number in tax systems that use Value-Added Tax (VAT). When you register for VAT in a single country, you receive this identifier for their system. We'll cover what exactly it's used for in a section below. Important note: A VAT number is not the same as a local tax number or tax ID.

VAT ödemesi nedir arşivleri Tembel Öğrenci

VAT calculator. Easily calculate sales VAT by selecting appropriate VAT rate in EU business' country, in that country's present currency. Here, you can both add or exclude VAT from amount. Simply enter number (e.g. sales amount), and then choose VAT operation: subtract or deduct VAT by chosen rate. VAT calculator & Currency converter.

The Difference Between Tax ID (TIN) And Tax Number In Germany lupon.gov.ph

Connect your sales channel to our software Please note, that the duration of the registration process depends on the country, as once your application is in the tax authorities' hands it is beyond our control While you wait, you can connect your Amazon Seller Account to our software

Kira sözleşmesi Vat number nedir

This means that we register your company within 24 hours, and register it for VAT, import, export etc., depending on your choices. Once the Danish Business Authority has processed your case, you will usually receive your CVR number within 7 days of sending the registration. Start your sole proprietorship with Legal Desk here (form in Danish).

Handling VAT Identification No. and Group VAT ID AppVision Kft.

A value-added tax identification number or VAT identification number ( VATIN [1]) is an identifier used in many countries, including the countries of the European Union, for value-added tax purposes. In the EU, a VAT identification number can be verified online at the EU's official VIES [2] website.

Vat Numarası Nedir? Bursa Tüzel Mali Müşavirlik

1. Look at an invoice or insurance document to find a VAT number. If a company uses VAT taxes in their prices, they'll usually list the company's VAT number somewhere on the document. Check for VAT numbers near the letterhead on top of the page or by the information at the bottom.

VAT Numarası (VAT Number) Nedir? Nasıl Öğrenilir? iyziBlog

Tax rate. In Turkey, the VAT rate is 20% of the cost of the service being taxed. For example, if you pay $100 USD in freelancer service fees, you will pay $20 in tax, for a total of $120. You'll see the estimated amount of tax on your invoices and Transaction History.

VAT Numarası (VAT Number) Nedir? Nasıl Öğrenilir? iyziBlog

Vat numarası, "Value Addet Tax" kelimesinin kısaltmasından oluşmaktadır. Vat numarası Türkçe'de Katma Değer Vergisi'yle aynı olduğu için vergi alanında kullanılmaktadır. Türkiye'nin vat numarası TR şeklindedir. Vat yani Katma Değer Vergi işlemleri 1954'te Fransa'da uygulamaya koyulmuştur.

VAT Numarası Nedir? VAT Nasıl Alınır? IdeaSoft Blog

Validation results include company's name and address, if provided. You need company's tax identification number (TIN), which is also used to check VAT registration status. Enter Thai TIN in the following format: TH and number that can have 13 digits. Please note that prefix TH is added for convenience.

VAT Amazon VAT Hizmetleri Yalmans Amazon Avrupa Danışmanlığı Hizmeti

IdeaSoft 9.35K subscribers Subscribe Subscribed 3.6K views 1 year ago Merhaba! 😊 Bu videoda, VAT Numarası'nın (Value Added Tax Number) ne olduğunu ve Avrupa'da vergi düzenlemeleri kapsamında.

Vat Numarası Nedir? Nasıl Geri Alınır? Vat Numarası Örneği Tercihini Yap

The VAT ID number, often referred as USt-IdNr, is the VIES number, used for all intra-Community transactions. A foreign business must first apply for a steuernummer at the corresponding tax office (in Germany, depending on your country of establishment, you are allocated a specific tax office).

Vat number nedir, ne işe yarar? Vat number nasıl geri alınır? Vat number vergi numarası alma yöntemi

VIES (VAT Information Exchange System) is a search engine (not a database) owned by the European Commission. The data is retrieved from national VAT databases when a search is made from the VIES tool.